Get Tax-Ready: Why Creators Need to Stay on Top of Payments and Invoices

The creator economy offers endless opportunities for creativity and financial growth, but it also brings unique financial challenges. From managing multiple income streams to tracking expenses for tax deductions, creator-economy workers like TikTokers, Twitch streamers, YouTubers, and others need to keep a close eye on their payment and invoicing practices to avoid stress during tax season. Staying organized and proactive can help you save time, money, and headaches down the road.

In this article, we’ll explore why staying on top of your finances is critical for creators. Plus, we’ll provide actionable steps to help you get tax-ready, from calculating your estimated tax liability to leveraging invoice software for small businesses.

The Financial Reality of Being a Creator

Unlike traditional employees, creators are often considered self-employed, which comes with additional financial responsibilities that full-time W2 employees don’t have to worry about. Here’s what sets the creator economy apart:

- Multiple Income Sources: Payments for creators often come from a mix of brand deals, ad revenue, tips from followers, royalties, and platform monetization programs like YouTube or Twitch. Each income stream may have unique payment timelines or requirements, adding complexity to your financial tracking.

- Irregular Payments: Creator income is rarely consistent—brand deals might pay in lump sums, ad revenue can fluctuate with engagement, and tips or donations vary month to month. This unpredictability makes budgeting and financial planning a greater challenge.

- Self-Employment Taxes: As a creator, you’re responsible for income taxes as well as self-employment taxes, which cover Social Security and Medicare. Since taxes aren’t withheld, staying ahead requires setting aside a portion of every payment for quarterly tax deadlines.

- Expense Tracking: From equipment and software to subscriptions and workspace costs, many business-related expenses are deductible. However, claiming them requires detailed records, such as receipts and logs, to justify deductions during tax preparation.

Failing to manage these aspects can lead to missed deductions, penalties, or even audits. To avoid these consequences and stay on top of your finances, getting your invoices and payments properly organized should be a high priority.

Why Staying Organized Matters

Of course, managing your finances is about maximizing your earnings and building a sustainable business as much as it’s about avoiding tax penalties. Here are some of the main reasons why organization is key:

- Timely Tax Filing: Keeping financial records organized prevents you from having to dig for records before tax deadlines. In turn, that can help avoid late fees or penalties.

- Accurate Reporting: Misreporting income can lead to audits or fines. Organized records make it easier to provide accurate information.

- Maximizing Deductions: Expenses like new equipment, internet costs, and editing software are often deductible, but only if you have proof of purchase.

- Cash Flow Management: Knowing your income and expenses helps you budget for growth and prepare for leaner months.

Steps for Creators to Get Tax-Ready

If you’re ready to take control of your accounting and invoicing, here are actionable steps to help you stay on track:

- Track All Income Streams

Use a spreadsheet or accounting software to record every payment you receive, whether it’s from ad revenue, sponsorships, or merchandise sales. Clearly label the source and date of each payment. - Learn How to Create an Invoice

It’s critically important for every creator to know how to create an invoice that meets common professional standards. When working with brands or sponsors, always provide an invoice that includes:

- Your name or business name and contact information.

- The client’s name and contact information.

- An itemized description of services provided.

- Payment terms and due dates.

- Separate Business and Personal Finances

Open a separate bank account for your creator-related income and expenses. This makes it easier to track deductible expenses and keeps your records clean in case of an audit. - Keep Receipts and Expense Records

Save digital or physical copies of receipts for purchases like equipment, software, travel, and even internet expenses. Use expense tracking tools to log these costs quickly and keep receipts easily available. - Set Aside Money for Taxes

Since taxes aren’t withheld from creator income, it’s important to set aside a percentage of every payment you receive for quarterly tax payments. Online tax calculator tools can help you estimate how much you’ll owe. - Hire a Tax Professional if Needed

If managing taxes feels overwhelming, consider consulting a tax professional who specializes in self-employment or the creator economy. They can help you identify deductions and ensure compliance with tax laws.

Tools to Simplify Financial Management

Managing your finances manually can increase the likelihood that you’ll overlook something, not to mention introducing another hassle into your busy day. Fortunately, invoice software for small businesses and other tools can help you automate the most labor-intensive processes. Some common ways to do this include:

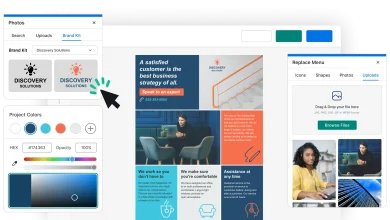

- Invoice Software: Automate invoicing, track payments, and organize records with tools designed for creators.

- Expense Trackers: Apps or software that categorize expenses and store digital receipts, making tax prep easier.

- Accounting Software: Programs that integrate income tracking, invoicing, and expense management into one platform.

- Tax Calculators: Tools that estimate self-employment taxes using up-to-date rates and help creators prepare for quarterly payments.

Common Tax Mistakes Creators Should Avoid

Even with the right tools, creators often make avoidable mistakes. Here are a few to watch out for:

- Not Reporting All Income: Platforms and clients will often issue 1099 forms for income over $600, but it’s your responsibility to track smaller payments as well.

- Mixing Personal and Business Expenses: Keep finances separate to avoid confusion and ensure all deductions are legitimate.

- Failing to Pay Quarterly Taxes: If you expect to owe more than $1,000 in taxes, remember that you must make estimated quarterly payments to avoid penalties.

- Missing Deductions: Failing to claim expenses like equipment, subscriptions, and workspace costs can result in paying more taxes than necessary.

Managing finances as a creator doesn’t have to be overwhelming. By staying organized, tracking income and expenses, and using the right tools, you can simplify tax season and reduce stress. Small steps, like learning how to create an invoice or setting aside money for taxes, help you focus on growing your business and thriving in the creator economy.